Untitled design - 1

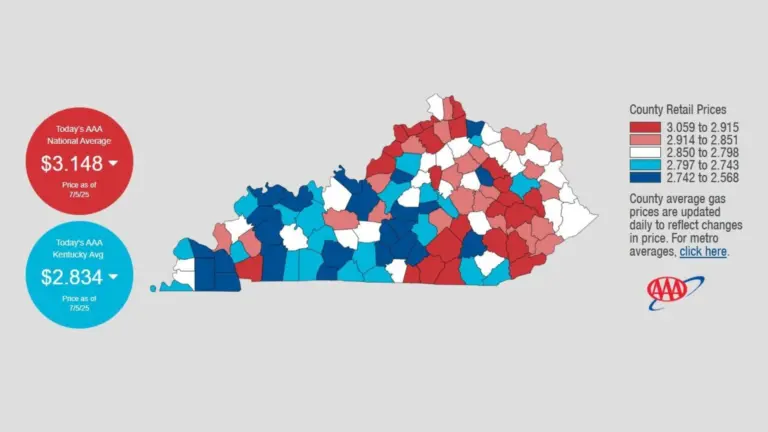

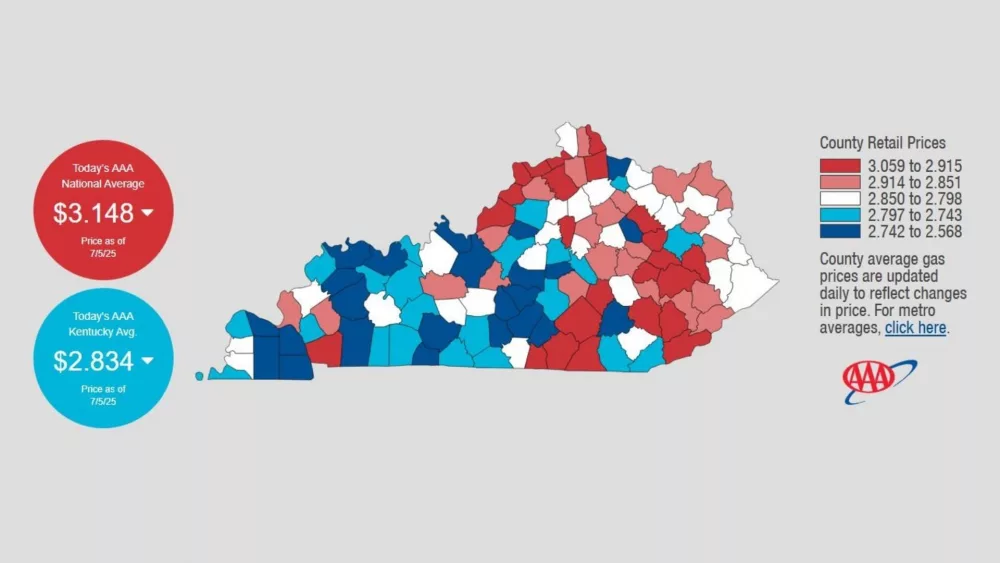

At the close of June, and according to the AAA East Central Gas Price Report, petrol products in west central Kentucky were trending around $2.81 per gallon.

That hasn’t changed much after the July 4 holiday, either, where average prices in the immediate News Edge listening area, as Monday morning, were roughly $2.77.

It’s $2.97 a gallon in Trigg, $2.65 in Christian, $2.77 in Todd, $2.88 in Caldwell, $2.68 in Hopkins, $2.79 in Lyon, $2.83 in Muhlenberg, $2.69 in Marshall, $2.71 in Calloway and $2.80 in Crittenden County.

Two weeks ago, it was $2.79 a gallon in the region, and one year ago it was $3.03. West Central Kentucky’s price record was hit June 13, 2022, when it was $4.74 per gallon.

The average price of unleaded self-serve gasoline across key spots in the Commonwealth is $2.76 in Bowling Green, $2.73 in Elizabethtown, $3.00 in Louisville, $2.67 in Owensboro and $2.87 in Paducah.

Nationally, gas prices increased eight cents in the final week of June to $3.22 per gallon, as crude oil prices stayed above $70 per barrel — in line with continuing tensions throughout the Middle East. U.S. airstrikes on Iranian nuclear facilities at the end of the month initially sent oil futures to $78 per barrel, but markets have since cooled.

Near the end of June, Iran’s Parliament voted to block the Strait of Hormuz, a critical passage for ships carrying about 20% of global oil supplies, and latest reports indicate that a final decision lies with the country’s Supreme National Security Council. According to officials, most of the cost of a gallon of gas is in direct correlation to the price of crude oil, and as it currently stands, these are still the highest oil prices since mid-February.

However, pump prices are 22 cents cheaper than last June, as oil supply in the market is outweighing demand.

In a mid-year analysis from AAA, the nation’s top 10 most expensive gasoline markets are California ($4.66), Hawaii ($4.48), Washington ($4.44), Oregon ($4.07), Nevada ($3.82), Alaska ($3.73), Illinois ($3.43), Pennsylvania ($3.38), Idaho ($3.38) and Utah ($3.29).

The nation’s top 10 least expensive gasoline markets are Mississippi ($2.73), Oklahoma ($2.82), Louisiana ($2.83), Tennessee ($2.85), Texas ($2.85), Arkansas ($2.85), Alabama ($2.86), Missouri ($2.86), Kentucky ($2.87) and South Carolina ($2.89).

Meanwhile, with the EV market remaining relatively stable, officials are beginning to calculate the average cost of public EV charging per kilowatt hour.

The nation’s top 10 most expensive states for said charging are Alaska (51 cents), West Virginia (51 cents), Tennessee (47 cents), Hawaii (45 cents), Montana (46 cents), Louisiana (42 cents), South Carolina (42 cents), New Hampshire (42 cents), Kentucky (42 cents) and Arkansas (42 cents).

The nation’s top 10 least expensive states for public charging per kilowatt hour are Kansas (26 cents), Missouri (27 cents), Maryland (28 cents), Delaware (30 cents), Nebraska (30 cents), Utah (30 cents), Colorado (32 cents), Iowa (32 cents), Massachusetts (33 cents), and New Mexico (34 cents).

Despite recent federal setbacks to clean energy through the “One Big Beautiful Bill,” electric vehicles remain on a fast track toward mass adoption — reshaping America’s roads, electric grid and job market.

By 2030, market research indicates light-duty EVs should top 30-to-42 million on U.S. roads, up from under 10 million in 2023. Market share has surged from 2% in 2020 to nearly 10% by late 2023, and globally, EVs are already displacing more than 2 million barrels of oil daily — projected to exceed 5 million barrels by decade’s end.

At present, and according insideevs.com, electric vehicles currently account for just 0.15% of U.S. electricity demand.

However, a fully electrified national fleet could draw up to 34% — which would require grid modernization. The average home charger requires 7 kilowatts, but large highway truck stops could demand at least 20 megawatts, and utilities face long lead times — often years — to upgrade transmission systems, while EV chargers can be quickly installed.

Opportunities, officials note, lie in managed charging, vehicle-to-grid technology and virtual power plants that can reduce infrastructure costs by up to 60%, and even act as backup energy sources.

Aging rural systems, cybersecurity and equity concerns remain key barriers in lowering costs across the U.S.

The EV boom also brings workforce shifts, requiring new training for electricians, engineers and auto technicians. Oil giants like Chevron, BP and Shell are reportedly adapting, having all expanded into EV charging and lithium mining ventures in the last decade.

According to the U.S. Department of Energy, and as of September 2024, Kentucky had fewer than 12,000 EV’s registered for road use, but as of April 2022, there were about 3,700 electric vehicles registered in the Commonwealth — showcasing more than 200% growth.

California, meanwhile, currently has 35% of the nation’s public EV fleet, with Florida and Texas closely in tow.